Welcome to the 87 new people who joined the onchain letters community since Sunday!

I'm thankful for all 604 of you and I hope everyone is having a great start to the week 🔥

If you're enjoying my writing, please share Onchain Letters with your friends in Crypto 🤝

A letter to Coinbase

Today's letter on Coinbase has 4 sections:

I provide a fun series of pictures from the original Coinbase blog on Tumblr from 2012-2016. Many of us entered the space during or after the 2017 bull run so it's cool to look back at how long Coinbase has been around and its early days as a startup.

In the second section I dive into the three pillars that cover all of Coinbase's products & services. Knowing these pillars can help you better understand how one of the biggest players in crypto is thinking about the road ahead.

I cover some key players and metrics from the different teams at Coinbase (legal, Layer 2, marketing, etc.)

And in the last section, I provide some considerations the crypto community needs to keep in mind as Coinbase gets larger. I also discuss the "GOAT bio: Ex-Coinbase" and how Brian's pragmatic leadership has helped influence a whole ecosystem of crypto companies.

Last week, Nick Tomaino posted this picture on Farcaster.

If you're in the crypto space, you probably recognize some of the folks: Brian Armstrong, Dan Romero, Linda Xie, and Nick himself. It was a record DAU (daily active user) day for Coinbase so the team was huddled around the laptop to celebrate.

Seeing this picture helped put into perspective just how long Coinbase has been around. There are a few companies alive today that can claim they've been grinding for more than a decade in crypto.

And the bizarre part is that the company's shipping velocity is only getting faster - Coinbase seems to have mastered persistent execution regardless of how high or low prices are. To a certain extent, Coinbase is the 'headquarters' for crypto in the western hemisphere. Especially since the fall of FTX, Brian Armstrong has become the de facto face of the industry.

Tomorrow, Coinbase is scheduled to report earnings for Q4 '22. With the Bitcoin halving coming up this year and prices hitting familiar all time highs from 2021, momentum is only going to get crazier for the ~5000 person company. Just in the past year, the company's stock has grown 148%. And that was in a bear market with record low volatility!

With that being said, if you want to better gauge the future of crypto, it makes sense to understand and follow Coinbase at an in-depth level.

Let's dive in 🚀

A trip down memory lane

My guess is that 85% of you reading this started actively contributing in crypto after 2017. So, in order for all of us non-OGs to better understand Coinbase's early days, I went through every single one of the company's tweets since 2012 and curated some of my favorites.

I wanted to have fun with this section so I made it less of an "essay format" and more so a scrapbook of key Coinbase moments from 2012 - 2017. In the early days, the company would do most of their comms primarily on Tumblr and then crosspost on Twitter.

The story starts on May 19th, 2012:

Here's a screenshot of how the Coinbase UI looked like in one of its early versions in July 2012:

After a Bitcoin social in SF: "This thing is really picking up steam" 😂

Up until this point, Coinbase was only Brian. Then in Jan 2013 he finally brings Fred Ehrsam onboard as co-founder:

By May 2013, Coinbase is processing $15m per month in Bitcoin transactions:

That same month, Coinbase raises a $5m round from USV. Fred Wilson describes Brian and Fred as very pragmatic, level-headed engineers.

Around then, Coinbase users were able to check their Bitcoin balance using SMS...remember when iPhone texts used to look like this:

In Feb 2014 (10 years ago now!), Coinbase hit 1 million consumer wallets:

A few months later, Coinbase moves into a new office in SF:

Here's a fun picture of a Marc Andreessen robot roaming around at the Coinbase office in March 2015:

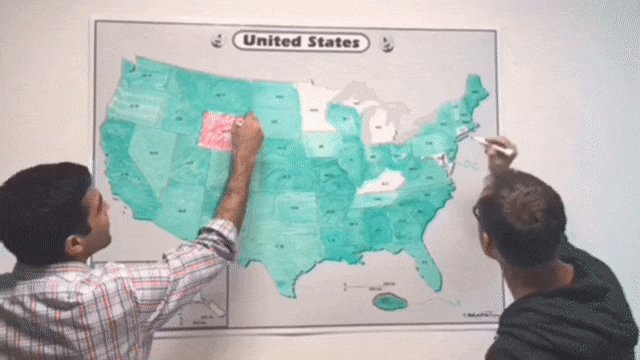

By March 2016, Coinbase had entered almost all 50 U.S. states:

In July 2016, Coinbase launched Ethereum on the exchange:

And I'll end this trip down memory lane with a tweet from the 2017 bull market that every founder dreams (and dreads) of:

Okay, now that we got some fun context on the OG days of Coinbase, let's talk more about how things are going right now. If anything, this past decade was just the pregame, the real party is about to get started.

Coinbase's three pillars

This past weekend, I was combing through the last Coinbase earnings report and saw this chart of all the different Coinbase services. The idea of Coinbase as "crypto's everything store" immediately made sense to me.

Honestly, seeing all these services blew my mind. I knew Coinbase was a huge company and had a variety of offerings but I didn't realize it was at this scale.

Now, I won't go through each of these individually. Rather, I think it's more important to focus on Coinbase's three pillar product strategy.

Crypto as an asset class

The first pillar, "crypto as an asset class", is primarily focused on the mission of making crypto accessible. To do this, the team has been pushing the going broad and going deep strategy. Simply put, Coinbase is looking to launch foundational products that serve as a gateway to crypto in every country while launching localized infrastructure to best meet the country's requirements (i.e. legal, UX, etc).

Last spring, they announced an 8 week international expansion drive in 6 continents. The initiative identified major crypto hubs such as UAE, India, UK, Japan, Canada, etc. and focused on teaming up with key government officials and financial & telecom partners in order to strengthen Coinbase's presence across a wide-range of international markets.

A few months later, they published an update on some of the actions taken:

Building more convenient ways for our customers in Singapore to access the cryptoeconomy

Launched our full crypto experience in Brazil

Took steps to further our commitment to the Canadian market

Accelerating our UAE plans with Abu Dhabi Global Market regulator

Pillar 1:

Make crypto an asset class across the world

Breakthrough a variety of regulatory and infrastructure barriers

Design products in a way that makes sense to all kinds of users

Crypto updating the financial system

This pillar is hyper-focused on making decentralized finance infrastructure mainstream. It's the logical next step after making crypto available as an asset class. First, make it available. Then, make it useful!

Think of all the things you can do with your bank today. Store money, earn interest, transfer funds, use a credit card, etc. Now, imagine all of that built completely on crypto rails. In a blog post from last month, the Coinbase team discusses how using crypto for everyday finance can save Americans so much money:

In 2022, Americans could have saved, at a minimum, about 74 billion dollars in credit card transaction fees alone, amounting to roughly 600 dollars per household, and merchants spent more than $126 billion on fees to process credit card transactions

It's worth remembering that people around the world are most excited about crypto as a solution to better financial access. It comes down to cheaper transactions, faster transactions, and better access.

One of the top use cases here to watch out for is USDC especially considering Coinbase's partnership with Circle. I mentioned this in my letter to Circle and Daimo last week, but we're just at the starting point of a stablecoin renaissance. There are going to countless stablecoin products built in the next few years as L2 solutions such as Base make it cheaper to do so.

"Most of fintech today is a set of thin wrappers that may seem clean at surface level but are a complete mess once you take a closer look...The combination of Base L2 + Coinbase exchange + Coinbase wallet + Circle/CB partnership seems like an unstoppable force."

Additionally, stablecoin plays a huge part in Coinbase's revenue growth:

Pillar 2: providing the existing financial use cases with an improved set of tools

Crypto powering the future of the internet

And lastly, Coinbase has been pouring time and capital in the last few years to start innovating on the app layer of crypto. Coinbase wallet, NFTs, Base L2, etc. are all great examples of initiatives the company has taken to bring the world more onchain.

And the great part is that they can easily tap into their global customer base and distribute these new consumer facing products.

For example, in January of this year, Coinbase announced a partnership with Yellow Card (African stablecoin exchange) to bring 20 African countries onchain. The goal is to enable millions of people to use USDC simply through Coinbase wallet and allow them to transact without any fees through the support of Base L2.

And they can do all this by simply sharing a link on WhatsApp or any of the other ubiquitous messaging platforms.

Last fall, Brian Armstrong came out with a list of 10 ideas that he would be working on if he wasn't already running Coinbase. The goal was to help spark some creativity and fund new builders through Coinbase Ventures. A few months later, CB Ventures hosted their first summit to gather aspiring onchain founders and help provide them resources to kickstart their new companies.

Pillar 3: help build and fund consumer applications to transition internet users globally from online to onchain.

To recap the pillars:

Making crypto a global asset class

Updating the financial system - banking through crypto rails

Bringing people from online to onchain

Firing on all cylinders

Now that we've covered Coinbase's three pillars, I wanted to provide some quick examples of folks from the Coinbase team doing amazing things.

Coinbase Legal vs D.C.

In the last year, Paul Grewal, the chief legal officer at Coinbase, and his team have been doing an incredible job of being transparent with how Coinbase is approaching U.S. regulation. It's been a never ending fight with the SEC and most of the legal proceedings are beyond confusing to everyone in crypto. Having someone who can simply translate what the heck is happening helps provide a ton of context on where we are with crypto regulation.

Additionally, last summer, Coinbase launched the "Stand with crypto" mint which became one of the most collected NFTs of all time. It brought a ton of awareness to the efforts being made in D.C. by Coinbase and other top crypto advocates/partners. On the standwithcrypto website, the team even graded top pro-crypto and anti-crypto politicians so people could better understand who to follow as well as how to contact their congressperson.

Based (L2)

Last summer, Jesse Pollak and his team launched Base layer 2 and conducted a mass marketing campaign known as "Onchain Summer". It was awesome timing because it got many people in the ecosystem excited again to take part of different projects launching in the Base ecosystem (i.e. Basepaint).

As mentioned in the earnings report:

"Our Onchain Summer launch event saw over 10 million NFTs minted across more than a million transacting wallets on Base and more than $500 million in assets on the platform. "

After Onchain Summer wrapped up, the initial hype died down and the team tried to figure out the path forward. It ended up being quiet for only a few short months. A few weeks ago, after Farcaster Frames launched, Base quickly capitalized on the new design space of frames and encouraged as many hackers to build on Base as they could. Jesse and the team sponsored multiple hackathons, supported builders through grants, encouraged use of other Coinbase products such as CB commerce, and went above and beyond on helping builders market their projects through the Base channel on Farcaster.

In fact, just today, the /base channel became the first to hit 100k followers.

Furthermore, Base is doing an awesome job of proliferating the onchain meme to the masses through unique storytelling. In the last couple of months, they've done some cool mints such as "No disc required" and "Get onchain today" to spread the word on how Base is bringing people onchain.

Coinbase Marketing

The Coinbase marketing team first got the spotlight at last year's superbowl when they put up their famous QR code ad which millions of people scanned to onboard to crypto. It was a huge success and one of the most creative ads I have seen during the Superbowl in the last few years.

But that was just the start. Since then, they've been cranking out ad after ad all touching different angles of crypto and have been exceptional.

I have had friends not involved in crypto whatsoever texting me that they saw a Coinbase ad that "just hit different". Props to the gigabrains on the marketing side doing a phenomenal job of giving the why crypto in a truly authentic way.

My favorite campaign so far has been this one called Break the cycle.

BTC ETF Winner

Lastly, I wanted to call out this tweet by my friend Gaut on who the real winner of the BTC ETF was. Coinbase, a publicly traded US company, was the goto custodian solution for all the ETF applicants. It was pretty much a no brainer for anyone from BlackRock to Ark to use Brian Armstrong's experienced and trusted team.

This win for the company was a result of playing by the rules for years and making sure the world - consumers and institutions - knew that they could trust Coinbase.

With that being said...how has Coinbase maintained such an edge in the crypto market for so long? Heck, even 2 years can feel like a lifetime in the crypto world. 12 years might as well be like three generations in the normal world.

Considerations & Pragmatism

Considerations for Coinbase

I'll start off the section by acknowledging that this was post was ultra-bullish on Coinbase which I am. The work the company is doing in all parts of crypto is incredible and exciting.

However, it's worth noting that as Coinbase grows larger and interacts with all kinds of stakeholders, it'll only get more important to keep a strong performance and track the numbers.

Some examples:

The exchange is notorious for exchange outages during a bull market. Will Coinbase be able to keep their servers running in this next hype cycle?

Is Base on track to be a stage two L2 by end of the year?

I mentioned above that it was a huge win for Coinbase to be the custodian for all the ETFs. But how secure is the system? (Btw, I have no idea how institutional custody works but just point out the lack of custodian diversity for the spot ETFs)

I mentioned this in a previous letter, but even when it comes to onchain activity such as eth staking...is Coinbase in the works of diversifying their staking client?

The point I'm trying to make here is that "with great power comes great responsibility".

It's our job as crypto natives to make sure we're being vocal about any possible vulnerabilities Coinbase faces. At the scale they operate on, even a slight mistake can have massive effects on the entire ecosystem.

And this doesn't have to be with malicious intent; rather, it's about adhering to one of crypto's core values: verify, don't trust.

Pragmatism

I never worked at Coinbase so I found this post by Dan Romero on Coinbase's pragmatism helpful to better understand what has made the company the holy grail of the industry.

You can read the whole post on your own time but I wanted to share three quotes that stood out to me. It comes down to believing in the values, realizing that people desire simplicity, and focusing on the importance of making pragmatic tradeoffs in order to scale.

Crypto wasn’t necessarily about trusting no one, but more about giving you a choice of whom to trust.

Power users tend to underestimate technical complexity and undervalue convenience. And convenience is what the vast majority of people want.

More than most technologies, crypto is inherently ideological. And that’s a good thing – many of the early folks joined Coinbase because they believed in those ideals. However, by leavening those ideals with a dose of pragmatism, Coinbase built something valuable that millions of people use.

A few months ago when CZ (founder of Binance) stepped down from his role as CEO because of legal issues with the U.S. government, Brian Armstrong put out a tweet underscoring his never ending focus on prioritizing trust and compliance over anything. He never got greedy in an industry that is plagued with get rich quick schemes. And though it may have seemed like he had lost his edge from the outside, it's clear that his patience and self-control paid off.

What's incredible about Coinbase is that it's not just responsible for one company. Coinbase has been grooming and inspiring a whole generation of crypto founders that have gone on to do amazing things after their stints at Coinbase.

Just within the Farcaster ecosystem, you have folks like Dan & Varun (founders of Farcaster), Colin Armstrong (founder of Paragraph), Linda Xie (co-founder of Scalar Capital and Bountycaster), Nick Tomaino (founder of 1-confirmation), Jacob (founder of Zora), Rish and Manan (co-founders of Neynar), etc.

The list is endless and it shows how much Brian Armstrong and Coinbase have influenced the crypto ecosystem.

Like I said above, this is just the start of the real party for Coinbase. Everything in these first 10 years was more so setting up the infrastructure. By 2030, I can't imagine where crypto will be and how far the applications will have come globally.

I'm excited to follow Coinbase's journey both in the short and long term. There's so much to learn from how the company operates and from all of the amazing people that have gone on to build the next big things in crypto with the same pragmatism Brian & Fred have preached since day 1.

That's all for today's letter - I hope all of you have a great rest of the week!

- YB

6

6